|

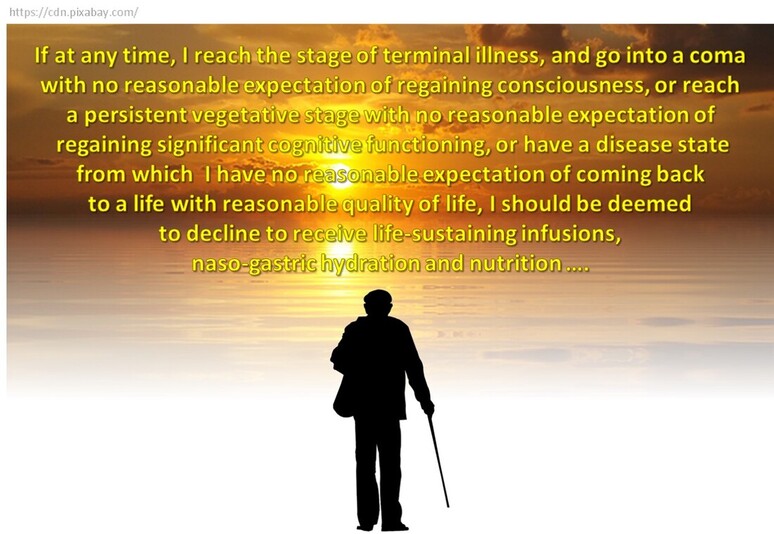

You know it is time. The disease has already won. You are ready to let go. But your family is not, nor are the doctors. As you lie there helpless, connected to so many tubes and machines, you sense your loved ones beyond the door, their fear, their sorrow. You wonder how they must be sacrificing to pay for all this. You want them to sit near you and hold your hand. And talk to you even if you can't respond. You want to tell them you love them and will always do. You know they love you, too. That is why you want them to remove all the tubes and machines. And just be with you at home, while you take leave. In peace, with dignity. If only you had told them how you wanted to go, when you could. The Guardian recently reported a study that found “the brain shields us from existential fear by categorising death as an unfortunate event that only befalls other people”. In other words, we are wired to deny life's only certainty, death. That being the case, it can be difficult to document our preferences about death. How can we think and discuss about how we want to be treated (or not) should we reach a terminal stage, a point of no return? But, think we ought to. Discuss we should. Document we must. The Supreme Court of India gave legal sanction to this “advance medical directive” or “living will” on March 9, 2018. The Supreme Court ruled that “in specific circumstances, a person has the right to decide against artificial life support by creating a living will,” and that “the right to life and liberty, enshrined under Article 21 of the Indian Constitution, also includes the right to die peacefully and with dignity.” Delivering the judgment, Chief Justice Dipak Mishra observed: “Should we not allow them to cross the door and meet death with dignity? For some, even their death could be a moment of celebration.” Will, living and deadDespite the ruling by the apex court, a living will remains a touchy issue. In 2015, three national medical associations of neurologists, intensivists and palliative care physicians came together to form the End of Life Care in India Task force (ELICIT). Dr Roop Gursahani, a consulting neurologist, who is part of ELICIT, says we “need to make conversations about death natural and not forced”. He points out that a living will “takes care of one’s healthcare decisions at the end of life." While living will formats can be easily downloaded from several sources (here is one), the government is yet to translate the Supreme Court ruling into enforceable procedures. Some experts feel what the court has suggested is too restrictive. You need to be certified terminally ill first, which may be too late. Also, the will needs to be countersigned by a judicial magistrate first class, who is not within easy reach of most people. Nevertheless, it is prudent to make a living will and communicate your preferences to your loved ones and those responsible for your health care. As it is difficult to plan for every eventuality, you can leave it to the discretion of one or two people whom you trust to implement your will. Financial planning Mention “will”, and one tends to think of a very legal-looking document. And of lawyers, and members of the family throwing not-necessarily friendly looks at one another. You also think of someone very ill, unlikely to be helped by all that he (or she) owns and has willed it away for others to enjoy. What matters most at the end is peace and dignity, at least for the patient. However, there is no wishing away the money elephant in the room. Fortunately, compared to the ethical and medical issues, planning for financial security is easier, provided you are willing to start long before it is time to make that final transition. Matters of money and anticipation when life is in transition A Certified Financial Planner, Sneha Jaggar recently qualified as a Financial Transitionist. Here she answers questions about finance and other issues at the time of life’s final transition. Q: Whether you wish to try everything possible to prolong life or decline heroic medical interventions, there are financial implications either way. How does one tackle this? Sneha: Life is a very delicate topic. My life is more precious to my near and dear ones than I perceive it to be. And this is often observed when a family member has to decide about treatment at the end of a loved one's life. These decisions are emotionally and financially draining if we do not know what the patient wants. You can help your family by having three things in place:

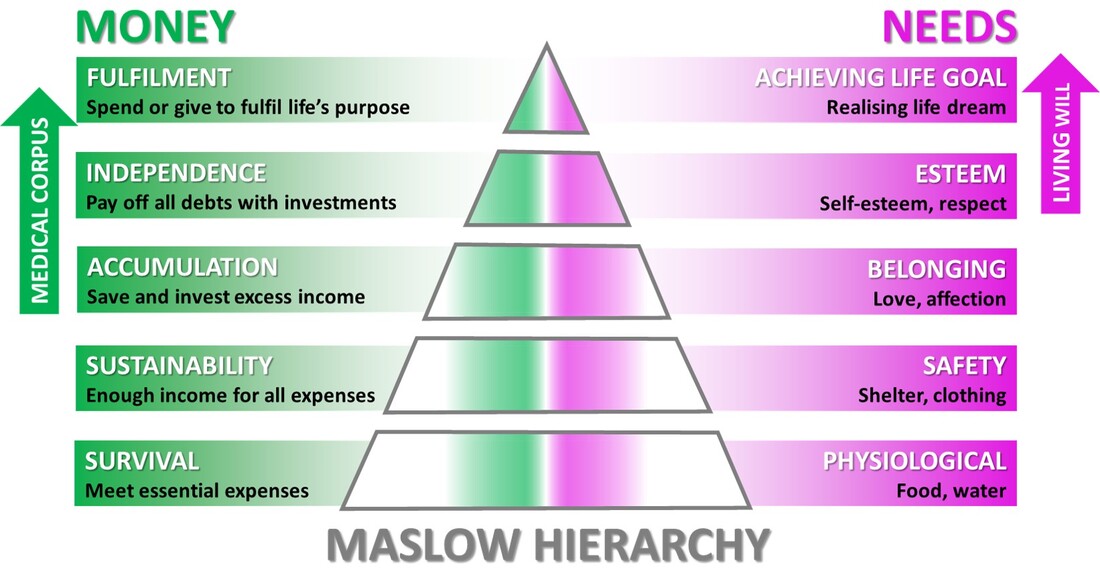

You help clients plan their life goals after retirement. Do you talk of terminal illness? Is it possible to quantify this requirement? Like I said, from the financial planning point of view, everyone should have the four basic insurance policies in place. However, as it keeps on increasing with one’s age, paying health insurance premium would be difficult after retirement. Additionally, medical inflation (cost of medical care) is presently the highest at 12% per annum. This is the reason why we need a separate medical corpus for the post-retirement period. When I speak to clients on retirement, I start by understanding their expectations. Many are practical. Some I need to sensitize about age-related illnesses. How much would they value their financial freedom should such a situation arise? The value of the corpus would depend on the individual and family, their standard of living, cash flow, net worth in the pre-retirement period, etc. These days parents prefer not to burden their children with end-of-life care. Do you have that conversation with the parent(s) or the children or both? Today, most parents are self-sufficient. However, they do need help in case of a medical emergency. Those who are still earning and want to be self-sufficient can build up a buffer for these emergencies. When I begin my conversations with parents, I try to understand where they stand in the Maslow hierarchy. When I know it is the right time to speak about legacy and wealth migration, I chart out detailed sessions with the parents first and then their children. During these sessions I speak not only about estate planning, but also about palliative care, end-of-life treatment and living will. Once the parents understand all this and are confident enough to talk about it, I involve the children. However, in spite of the Supreme Court ruling, the legal status and practical applicability of the living will remain hazy. Therefore, I tell my clients they should consult their doctors and lawyers about this. One son abroad is fully bearing the cost of treatment. The second son in India is the 24-hour caregiver but has no money. They have conflicting views on what is best for the patient, their father. How do you tackle such a situation? In this scenario of transition, both the sons are in what we call the anticipation stage. You expect an event (end of father’s life) to occur but that has not yet happened. Both the sons portray struggle traits in their behaviour. The one abroad is probably feeling helpless as he cannot be present physically. The other one is experiencing emotional fatigue, where he cannot see his father suffering in front of his own eyes. As a financial transitionist, I would use certain tools to help them clear their fears and frustrations. Then help them arrive at a decision that both are happy with and is best for the father, too. If one has drawn up clear plans after discussions, how to ensure those are enforced when the patient is totally helpless? For example, the patient may expect a certain course of action but the spouse may act entirely differently. I cannot speak on the legal position, but some of the issues here are that of understanding and expectation. Generally, financial planners/advisors talk about goals because they’re trained to craft them, and create timelines and benchmarks. Expectations are the spaces that exist in the narrative about goals. Some are vague, some are small, and some are fleeting. Regardless, they’re all important because they influence the thoughts and behaviour of the client. What makes expectations complicated is that they’re frequently not verbalized. Someone may or may not be correct about their perception of the expectations of others, even their near and dear ones. Regardless, expectations can create an unseen but powerful undercurrent that influences relationships, behaviour and satisfaction. When left unexplained while making important decisions, those details become little spaces of uncertainty that could create financial and personal problems. I help clients write down their assumptions and expectations regarding an event yet to occur. I also discuss the time horizons to gain greater clarity about why they have these expectations. Based on similarities and differences, I help determine the next steps most relevant to them. It could involve separate one-on-one discussions or joint sessions. This helps verbalize the thoughts and expectations one has of the other and brings the differences to light. Then it becomes easier to work towards a common ground. When is the right time to talk of the living will? Again, when I introduce this topic would depend on my comfort level with the client, his or her age, life circumstances, background and standard of living. For example, if I’m talking to a just-married couple, I will have to be rather sensitive about broaching the subject of a medical corpus. However, if either or both of them have already had close encounters of the medical kind involving someone close, they would be already sensitized. It would be easier to talk about medical corpus, end-of-life treatment and living will. In your opinion, what can be done to minimize confusion and ensure dignity at the end of life? Just to sum up, five actions can help a lot:

Have another question? Ask Sneha Jaggar.

3 Comments

Mehul Panjuani

31/10/2019 05:41:34 pm

Very thoughtful article with pertinent information on planning the most vulnerable phase of life

Reply

Suprabha

31/10/2019 10:08:59 pm

A much needed read. Children/spouses are often paralyzed during crucial medical decisions. We never know what the subject's choice would have been. Here, if there is a way legally, then it's time to think and act on it.

Reply

Jigisha

11/11/2019 04:50:17 pm

This is the rarest of topics that I've ever read anything on. A very knowledgeable one. It helped me come face to face with situations of the kind mentioned and experienced by me in my past with regard to the ones' whom I have lost to death. Superb article.

Reply

Leave a Reply. |

AuthorVijayakumar Kotteri Categories

All

Archives

July 2024

|

RSS Feed

RSS Feed